Solar

TradeRiver has identified the Solar industry among a number of high growth industries where innovation and disruption are either happening or in desperate need of occurrence. Here’s a quick dive into all of the things we’ve highlighted about the Solar industry.

Industry Insights

The global solar energy market size is forecasted to reach $422 billion by 2022. The world’s energy demands continue to grow in unison with environmental incentives and renewable energy expansion. The solar energy industry is constantly innovating current technology to enhance efficiency while producing equipment that is feasible to both access and install.

The rising interest in solar energy is not limited to the panels we can see on rooftops. Solar energy is versatile in nature and continues to develop and appear in diverse applications. In an age when being green is paramount, solar innovations are constantly producing new initiatives to find new places to apply clean energy restoration.

TradeRiver Highlights

Along with a growing number of U.S. towns, cities and states, major corporations are setting 100% renewable or zero-carbon energy goals. Pressure from consumers to address the issues of climate change and environmental pollution, along with government policy mandates, plays a role in the growing energy shift.

Major corporations are at the forefront of the renewable energy transition and growth trend. Target, Walmart, and Walgreens have the highest number of individual solar installations and continue to push for their energy goal.

The solar industry has two main challenges: the ongoing need for energy storage for nighttime and the effects of cloudy or inclement weather on solar electricity production. The invention of the solar balloon introduces a new solution that produces clean energy both night and day.

The solar balloon combines solar electricity production during the day with the production of hydrogen to further produce electricity after the sun goes down. Companies like CoolEarth and NextPv are integrating the solar technology in an effort to produce enough clean energy to address the global energy crisis.

Solar shoppers are presented with more panel options than ever before. The saturated panel manufacturing space is making room for the thin film solar panel. The narrow design has produced strong durability while maintaining the lightest PV cell.

Companies like First Solar, Solar Frontier, SoloPower, and Sharp are contributing to the research and development of cell efficiency and further penetrating the residential and commercial market with thin film solar applications.

Renewable energy is a hot commodity among investors. As solar power begins overtaking fossil fuels, margin opportunities have expanded into artificial intelligence. AI is making clean energy attractive for investors.

Currently, digital technology investments have focused on making renewable energy cheaper and safer. Companies like Xcel Energy, General Electric, and PowerScout are using AI technology to improve renewable energy operations.

The energy intensity of brewing beer is substantial. While microbreweries and craft beer have grown in popularity in recent years, so has the increasing need to be environmentally conscious and friendly. As a result, these breweries are utilizing renewable energy in production.

There are more than 130 breweries around the country that are using solar energy to brew their beer. Canal Park Brewing Company, Mad Mole Brewing, and Maui Brewing Co. were voted and crowned America's favorite solar-powered craft breweries in the most recent Brews from the Sun competition.

Space-based solar power (SBSP) has been publicly perceived and accepted as science fiction; however, as the world searches for new sources of clean energy, space has grown in recognition as an opportunity to harness solar energy from the sun and transmit it wirelessly to Earth.

Conversation of investment in space-based solar infrastructure and technologies has increased as the world has grown in desperation for a solution on behalf of energy needs and climate change. Although a grandiose vision, companies like Space Energy, Inc., Northrop Grumman, and Caltech are actively exploring ways to enable solar power to be continuously available anywhere on planet Earth.

The energy transition has enabled the reality of many sustainable applications and solutions. Solar powered roadways may sound futuristic; however, they have been in innovation and development phases for some time in an effort to build roads that are able to harvest solar energy and produce energy locally.

Companies like Wattway and Solar Roadways are working to create the world’s future solar surface. The combining of road construction and photovoltaic techniques has enabled the strategy to restructure urban environments and environmental issues.

Over the past decade, the development of alternative, renewable sources of energy have taken priority over fossil fuels. As the solar industry gears up to innovate further, expansion in solar energy grows in unison with the majority of public support.

Solar power is in a constant state of innovation. Solar startups like Sistine Solar, Solar Reserve, and AES are constantly increasing competition and creating new milestones introducing solar efficiency, energy storage, wearable solar, solar design tech, etc.

PACE activity around the country

Commercial and industrial buildings are responsible for over a quarter of primary energy consumption in the U.S. With the cost of solar dropping significantly, Commercial Property Assessed Clean Energy (C-PACE) has gained widespread adoption and traction. C-PACE provides companies and property owners with assistance in their sustainable efforts to improve property bones and functionalities.

With the overall increasing interest in building efficiency and energy savings, many C-PACE projects are emerging or are already in development stages. Companies like CleanFund, GreenWorks Lending, and Abundant Power Group have been named financial allies in the ongoing effort to fund energy upgrades, making properties more valuable.

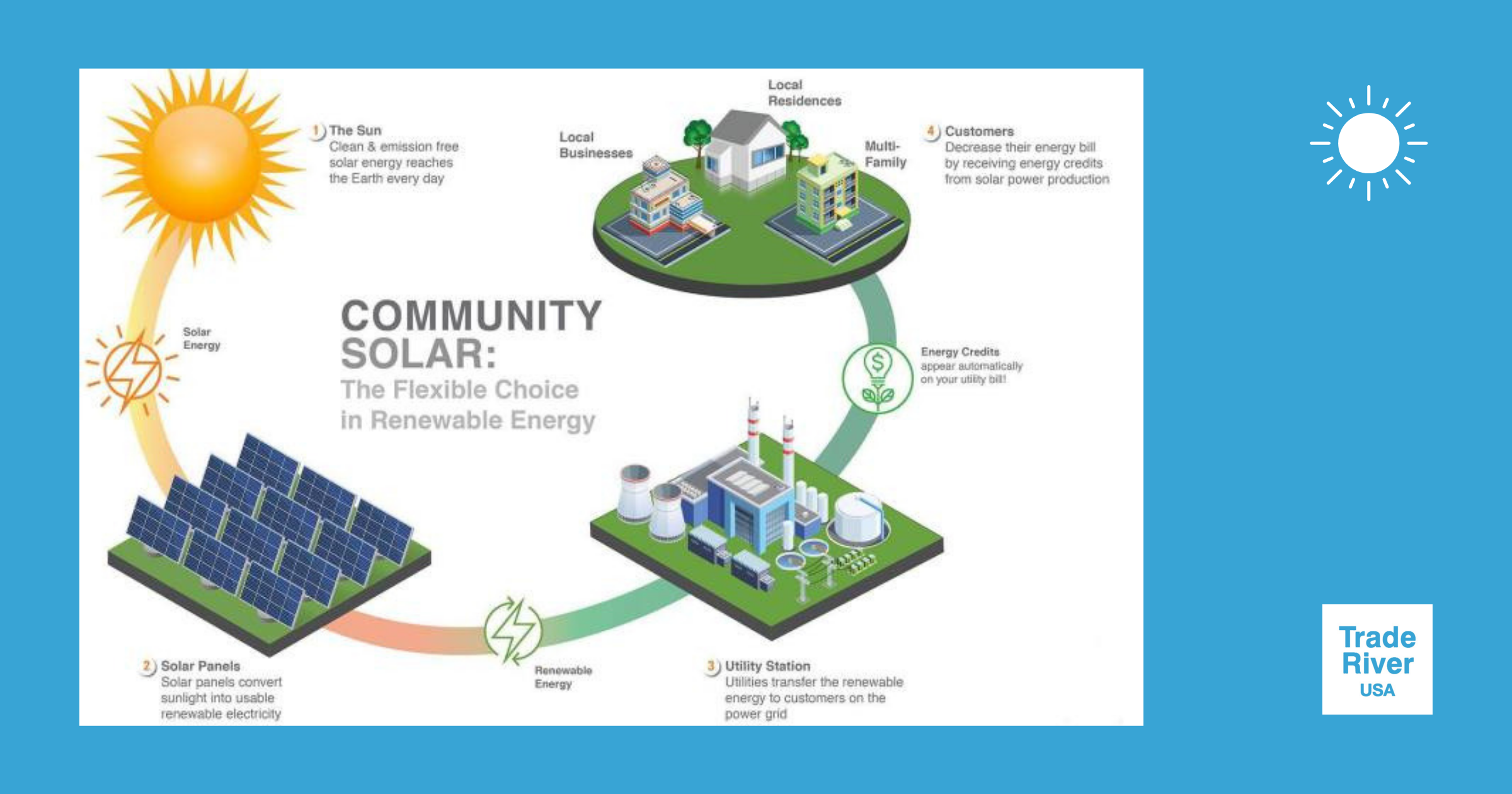

A relatively new concept, community solar, is a solar power plant whose electricity is shared by more than one household. The purpose of the project is to allow members of a community to share and reap the benefits of solar power collectively. With this newfound opportunity, virtually anyone can go solar without having to install solar panels on personal property.

New groups, companies and utilities are entering the industry and building community solar projects. Arcadia Power, Nexamp, and SunShare are some of the companies engaging in the early adoption of the renewable energy project.

Solar Thermal Cumulative Capacity by Region and Global Gross Additions

Unlike the saturated, mainstream solar PV technology, solar heating and cooling technologies collect thermal energy from the sun and use the sun’s heat to provide hot water, space heating, cooling, and pool heating for residential, commercial, and industrial applications.

BrightSource Energy, Abengoa Solar, Siemens, and Acciona are some of the early disruptor companies that are tapping into the less traditional renewable energy technology and working to raise awareness and overall implementation.

As of 2019, 200,000+ homeowners made $5 billion in energy efficiency improvements to their homes through PACE financing. Specifically for homeowners who want to apply and enjoy the benefits of solar, Residential Property Assessed Clean Energy (R-PACE) is a program that provides financing solutions for home solar power application.

Many homeowners are boarding the R-PACE bandwagon and simultaneously cutting billions of dollars of wasteful utility bill spending. Renew Finance and Ygrene Energy Fund provide services and funds to property owners who want to make clean energy improvements to their property.

Annual Photovoltaic Module Shipments Total Shipments in Peak Kilowatts and Cost per Peak Watt June 2017-May 2018

Companies involved in utility-scale projects are feeling the pushback from solar tariffs and suffering a hit on equipment imports. Large solar farms, for which panel prices are an essential variable, are making operational adjustments to meet stakeholder demands while working in spite of the trade dispute.

Despite the unpredictable landscape, manufacturers are managing their standard procedure of operations and maintaining pace by relocating or expanding their factories onto U.S. soil. JinkoSolar, LG Electronics, and SunPower are uprooting their facilities to effectively meet transaction deadlines and continue to scale in the wake of renewable energy.

Growing uncertainty regarding solar tariffs and their lasting impact has slowed progress. It is widely believed that a boost in the industry would benefit the solar sector. Solar energy jobs have stagnated and dipped after the industry's peak in 2016. After much speculation, indications have produced cause for correlation between recent solar tariffs and the widespread unemployment of the solar workforce.

The current solar market is heavily populated with companies that are anticipating and actively looking to get ahead of unforeseeable problems or limitations. Hanwha Q CELLS, JA Solar, and Trina Solar are some of the largest and top performing solar manufacturing companies that are prepping their business models to maintain their position in the solar energy market no matter the future industry landscape.

Every facet of the solar industry is monitored and affected by local, state and/or federal policy. Among the popular deployment of renewable energy, policy plays an extremely important role on the back end of solar arrangements. While deploying solar energy, policy works to foster competitive markets for new and innovative energy technologies and solutions.

As policy continues to impact the growing solar market, more and more household brands are expanding their services and pivoting their bottom line to encompass solar. Companies like Ormat Technologies Inc., Pattern Energy Group, and TerraForm Power are solar-focused while appealing to diverse sectors ranging from utilities to industrials to energy, etc.

Utility-scale solar produces clean energy as well as stable fuel prices. The legislation of both federal and state-level policies function to both contribute to and accelerate the growth of utility-scale solar while also reducing energy bills and generate more jobs with solar.

Recently, many power purchase agreements (PPAs) were signed, welcoming numerous new utility-scale solar projects into the market. The utility-scale market is forecasted to grow and ultimately account for nearly two-thirds of the total solar sector. As the market diversifies, corporations are at the vanguard of the renewable energy market. Companies like Apple, Nike and Smucker's have adapted and embraced corporate PPAs, having contracted for renewable capacity.

Residential Installations

Residential solar installations have created a sustainable growth profile while operating with both local, regional and national installers. It is apparent that as the solar market continues to scale, many consumers are converting and adopting renewable energy.

Sunrun, Vivint Solar, and Sunnova are considered some of the biggest players in the American solar industry. With a large reach enabling affordable and cleaner power, services are strategically crafted to be made accessible to U.S. homeowners.

Solar Capacity

The solar PV landscape has witnessed a lot of competition. Despite several cost impacts and tariffs, the industry has seen geographical expansion beyond traditional markets and the introduction of industry disruptors.

Cypress Creek Renewables, First Solar Inc., and NextEra Energy, Inc. are companies owned or developed by pre-construction, under construction, and operating solar capacity (MW). These companies deliver PV energy solutions in up and coming, emerging solar markets to fuel expansion efforts.

Floating solar is a relatively new concept that is slowly penetrating the solar market. While in the early adoption phase, the new solar technology is predicted to have boundless market potential. Floating solar is a solar farm that is built to float and placed on a body of water.

As the alternative to land-based solar power systems grows, companies like D3Energy, Ceil & Tier USA, and Swimsol are pioneering the floating solar industry and bringing solar power to places where land is scarce. These companies are working to build healthier environments overall.

As the deployment and implementation of clean energy technologies continues to spread, solar flight is working to become a driving force in the renewable energy market. Solar flight has created flight without fossil fuels.

Shifting to a more sustainable model, solar powered planes are aggressively improving air technology. Solar Impulse Foundation, Solar Flight Inc., and Aurora Flight Sciences are introducing vast new possibilities for connectivity.

Researchers are actively seeking new ways to generate solar energy for human needs. Industry innovations continue to take solar power applications to the next level, like solar windows, solar paint, solar tiles, solar roof shingles, solar lights and so on and so forth.

While solar is on its way to dominate global energy, many companies are making their businesses profitable with solar power. Massive corporations like Target, Walmart, and IKEA are installing solar capacity and adding renewable energy initiatives to their portfolios.

The demand for electric vehicles correlates directly with the growth in demand for low emission vehicles and the overall renewable, fuel efficient movement. Electric vehicles are predicted to account for 7.6 percent of the automobile market by 2026.

Companies like Coda Automotive, Wheego Electric Cars, and Fisker Automotive are working hard to increase the electric car adoption rate and decrease reliance on fossil fueled vehicles by ultimately replacing them.

Solar panel systems have become so popular that they have introduced another technology called the solar battery. Solar batteries function to store extra solar power for later use. The installation of this solar technology helps manage electricity flow from renewable resources.

Companies are working to achieve the integration of renewable technology in the electricity mix. Powerwall, AIMS, and Sun-Xtender produce durable, low maintenance batteries for both residential and commercial properties.

Manufacturers are growing increasingly excited as a new solar product enters the market. Bifacial solar panels are working their way into the mainstream as more and more consumers integrate solar power in their energy plans.

Bifacial solar modules capture sunlight and produce electricity on both sides of the solar panel. Prism Solar, Auxin Solar, and AE Solar are optimizing solar projects and increasing efficiency to create better performing solar panels and synergy between both front and rear facing exposures.

Solar powered irrigation systems provide a newfound solution for water management in agriculture. Agriculture is an energy intensive industry. Integrating solar as a means of energy can reduce and ultimately mitigate greenhouse gas emissions released from growing and harvesting crops.

Typically, irrigation systems rely on traditional forms of energy such as fossil fueled powered water pumps. Flexcon Industries, Grundfos, and Square D continue to innovate the up and coming solar application to ultimately replace the norm with renewable energy.

Landfills are commonly characterized as dead space. Because of this, landfill-based solar arrays are becoming more prominent. The installation of solar power in unused, capped landfills generates revenue and energy; repurposing the land into an asset.

WatershedGeo and Ameresco are delivering meaningful energy efficiency and renewable energy to communities seeking to reap economic and environmental benefits with solar facilities and power.

Co-locating solar farms and honey bee apiaries has grown in popularity upon solar’s newfound initiative to save the bees. With equal priority given to agricultural functions and biodiversity, solar sites are producing an abundance of bees, among other insects.

As solar farm apiaries continue to cash out on a two for one deal, companies like Pine Gate Renewables are partnering with apiaries to produce and combine both clean energy and beehives.

Both oil and gas companies are making strategic pivots in their business models to adapt to the changing energy landscape as the renewable energy transition continues to accelerate.

As renewables are forecasted to grow faster than oil demand, companies like Premier Oil, Soco International, and Ophir Energy are investing in green energies and clean technologies to join in the new energy economy.

The outdoor and landscape lighting sector have been disrupted by solar lighting. Solar lights are an easy way to decrease carbon footprints and contribute to the replacement of fossil fuels.

GamaSonic Solar Lighting, Sepco Solar Lighting, Solar Light and other companies are providing advancements to light sciences and consistently driving the industry forwards by meeting all human needs with solar.

Over the past decade, corporate solar adoption has increased. Companies are taking the reins on energy costs in an effort to reclaim their brand’s bottom line by lowering operating costs and increasing profits. Solar energy is being deployed on a massive scale by iconic brands and notoriously well-managed U.S. organizations.

Growth in corporate solar demand is due primarily to declining prices. As for commercial solar, companies like Switch, Prologis, Kaiser Permanente, Solvay and others account for some of the top corporate solar users in the U.S.